Europe toll road giants eye deal

Mr Rutelli has expressed misgivings about the deal

Italy's Autostrade and Spain's Abertis have agreed a merger which will create the world's biggest toll road operator.

The new firm would have a market value of around 25bn euros ($31bn; -£17.3bn).

But some senior Italian politicians are against the deal, under which toll group Abertis would swallow the Italian roads firm in a one-for-one share swap.

The new headquarters would be in Barcelona, with an Italian office in Rome. Abertis took control of motorways in north and eastern France last year.

Francesco Rutelli, an ally of general election winner Romano Prodi, said he had "severe doubts" and told Italian papers that "a monopolist would strike such an important deal in the absence of a government with full powers".

The centre-left coalition under Romano Prodi has yet to form a government, and some analysts said the deal was taking advantage of the political limbo.

Members of Silvio Berlusconi's centre-right Forza Italia have also raised fears about any merger, as have some Italian trade unions.

'Best in class'

But Autostrade, privatised in 1999, called the deal "a merger of equals".

It said the deal would create "the world leader in the motorway sector" and "best in class for the construction and management of infrastructures, particularly focused on transport infrastructure".

It is believed Autostrade wants to use Abertis's engineering skills to win large European Union contracts for roads linking eastern and western Europe.

In Italy there has been criticism of Autostrade's dominant market position, which has allowed it to post booming profits due to high tolls and a lack of competition.

The Benetton family, which owns the fashion stores chain, holds 50.1% of Autostrade through its holding company Schemaventotto, and will have a 24.9% holding in the new group.

Major Abertis shareholders such as savings bank La Caixa and building firm ACS will hold 11.7% and 12.5% of the merged company respectively.

Cross-border rows

The proposed merger also raises the issue of possible economic protectionism, with a number of spats recently over mooted cross-border deals.

This year began with the French government setting out its protectionist stall, approving a decree which imposed conditions on foreign takeovers in 11 key industries.

Then came Netherlands-based Mittal Steel’s bid for Arcelor, which stoked up a wave of opposition in France and Belgium.

Meanwhile, the Spanish government has objected to a plan by Germany's Eon to buy Endesa.

And at the end of 2005 - prior to an Abertis-led consortium taking control of Sanef, which operates motorways in the north and east of France - there was a threatened political backlash over the deal.

FJ-GF GIUSTIZIA FEDERALISTA

+ 39 329 85 30 842

Mestre Casella Postale 30

Mestre Venezia , Italia

Ultimi Articoli

Medeglia — Un terreno edificabile in quota tra natura, vallata e futuro abitativo

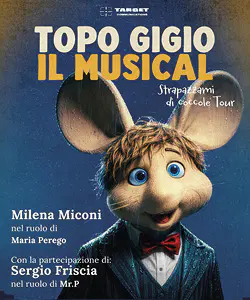

Topo Gigio torna a teatro: al Lirico di Milano il musical che unisce nostalgia televisiva e spettacolo per famiglie

Dal cinema al palcoscenico: “Fantozzi. Una tragedia” arriva al Teatro Carcano di Milano

Vendere o comprare casa in Ticino senza agenzie: la nuova linea di comunicazione immobiliare

Ticino, vendere casa senza agenzia non basta — la comunicazione immobiliare fà la differenza

Festa della Donna a Palazzo Lombardia — Belvedere aperto senza prenotazione e piazza in festa

Frankenstein Junior – Il Musical al Teatro Nazionale di Milano: dal 6 all’8 maggio 2026 torna il cult di Mel Brooks

Lombardia per le donne — 400 euro al mese per sostenere lavoro e carichi di cura

“Volevo essere io”: Valeria Graci in scena al Teatro Manzoni di Milano